The guest speakers on the first day were Elston Neil Menezes and Sapna Shenoy. They touched upon issues such as wealth accrual and strategic nuances underpinning long-term financial planning. Delving deeper, they expounded on adept strategies for astutely managing debt and equity portfolios, aiming to optimise returns while mitigating inherent risks. The intricacies of diverse debt instruments prevalent in the financial echelons were unraveled, alongside a comprehensive elucidation on market indices such as Sensex and the dynamic vicissitudes characterising the stock market. Noteworthy guidance on prudent equity investments, encompassing risk appraisal and portfolio diversification strategies, were enumerated with a short film ‘One Idiot’.

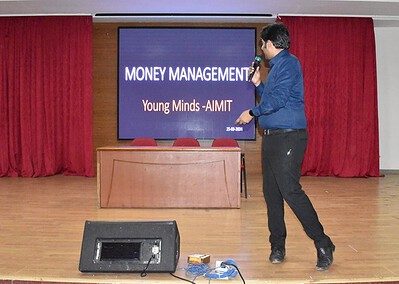

The guest speakers for the second day were Naveen and Leo. Mr. Naveen’s took a session on financial literacy, unraveling the mystique surrounding compounding dynamics, market vicissitudes, prudent spending habits, investment stratagems, and judicious allocation of savings. Complementing this discourse, Mr. Leo’s session, titled “Back to basics,’ explained rudiments of mutual funds, personal finance fundamentals, meticulous budgeting, retirement and debt management imperatives, the indispensability of emergency funds, insurance nuances, astute investing practices, and the significance of credit scoring.

Post-lunch, Yvonil D’Souza’s did a case study on Kamath brothers’ narrative, underscoring the criticality of identifying pivotal life junctures, differentiating between intelligent investing and speculative ventures, and accentuating the indispensability of financial cushions such as emergency and retirement funds.

Ranked 58th

Ranked 58th